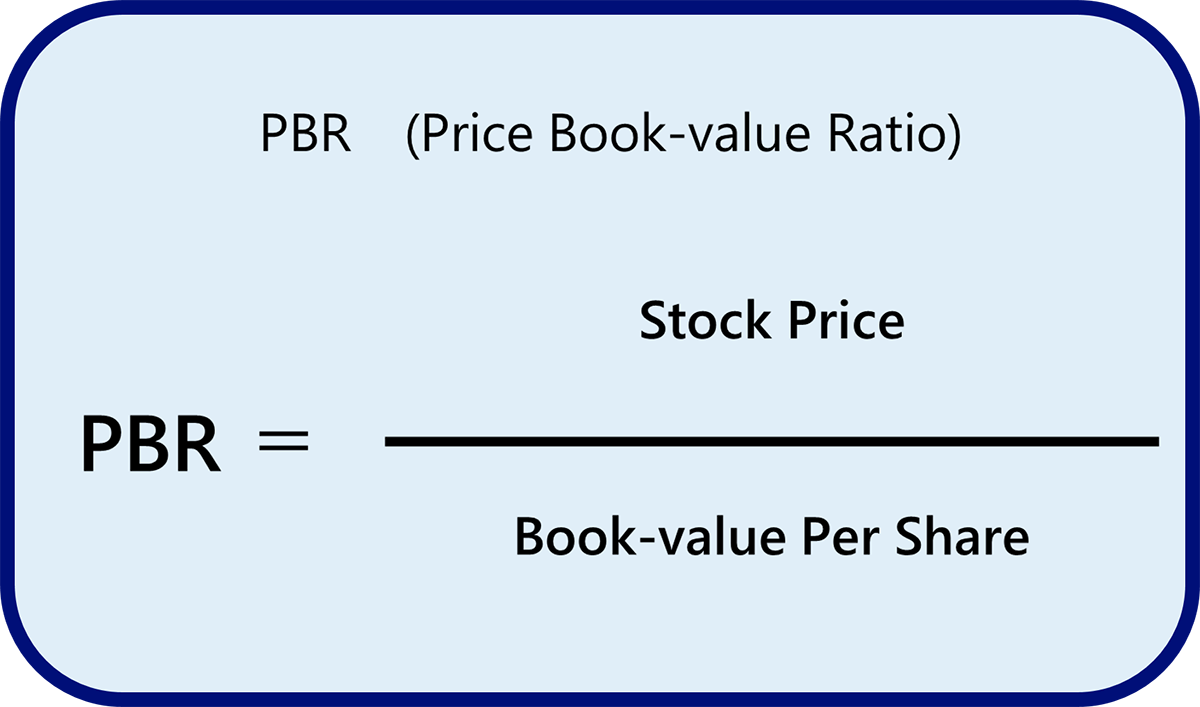

What Is PBR

PBR, which stands for Price Book-value Ratio, is a stock price index that shows the ratio of a company’s stock price per share to its book value per share.

Why Did PBR Gain Attention

PBR attracted attention in 2023, when the Tokyo Stock Exchange (TSE) propose a management that realizes cost of capital and stock price conscious management, and requested listed companies with PBR stagnant and below 1 to disclose and implement remedial measures. A PBR is 1 means that market capitalization and net assets are at the same level.

Why Is a PBR Below 1 a Warning Sign

This does not mean that a company with a PBR over 1 has no problems.

When a PBR is below 1, it might be better for the company to be acquired and dissolved than to continue the business.

This does not mean that a company with a PBR over 1 has no problems.

This is because a PBR fluctuate depending on factors beyond the company's control, such as interest rate trends and investor sentiment, and the average PBR for U.S. companies is 3 to 4 times, and for European companies it is about 2 times.

Points to Note When Using PBR

The standard PBR figures vary depending on the industry and business type.

Industries with low profit margins relative to their asset size tend to have lower PBR than other industries.

The more mature the industry, the lower the PBR tends to be.

As a result, it is not possible to simply compare the PBRs of companies in different industries or business types.

PBR above 1 is not necessarily a good thing.

The PBR will rise if stock prices rise in the short term and net assets decrease.

Shareholders return measures such as share buybacks and dividends can be effective.

However, unless a company's profitability and growth potential are improved sustainably, it will be difficult to continue shareholder return measures, and management efforts to increase profitability and growth potential are essentially important.

How Can Companies Raise PBR

- Improvement of earning power through business portfolio management

- Back casting strategy, which involves strategic thinking for setting goals and developing plans by calculating backward from the future

- Investment with certain risks for growing

An important point for increasing corporate value is that management properly identifies management issues, redesigns organizations and businesses that adapt to changes in the environment, develops concepts, and considers issues from a medium- to long-term perspective.

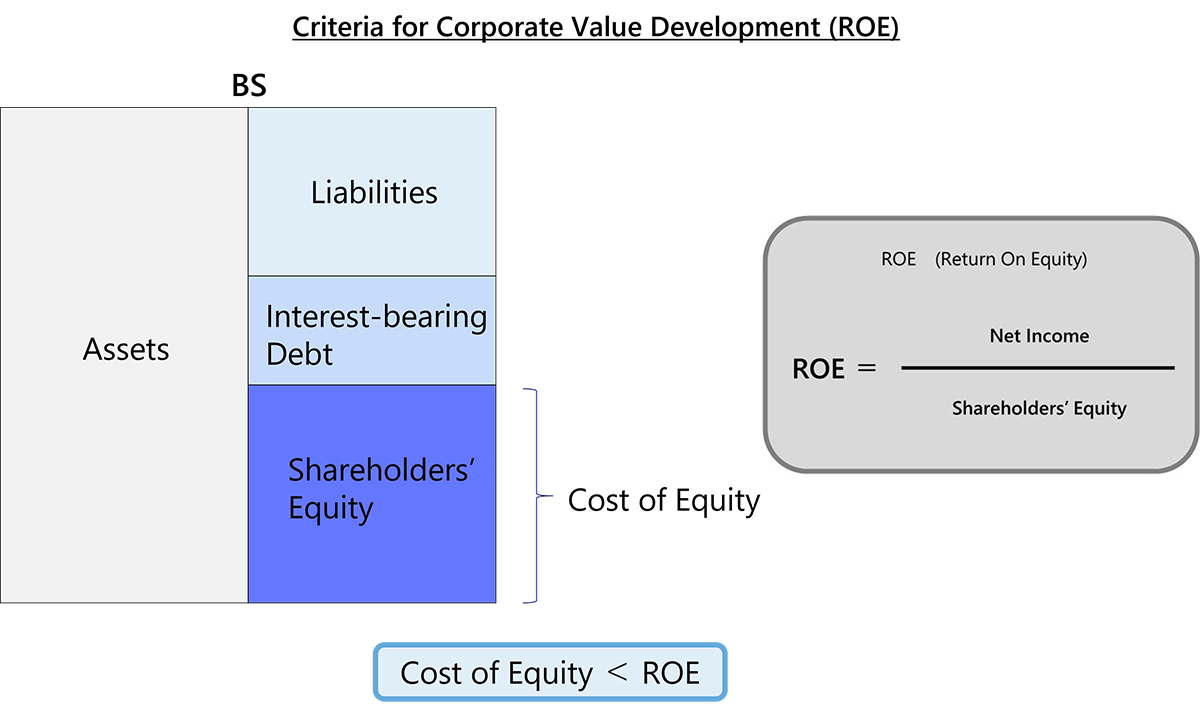

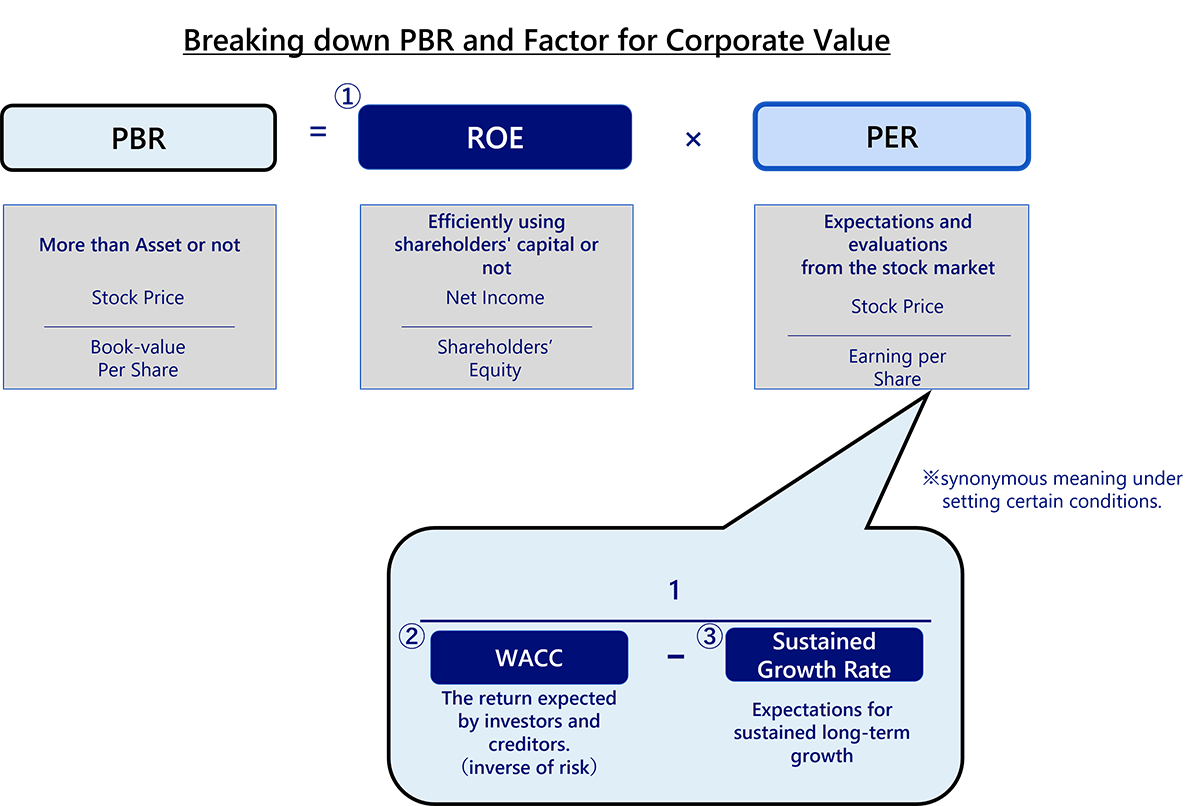

ROE represents profitability, while PER represents shareholders' expectations of a company's growth.

The lower the equity capital (or shareholders’ equity), the higher the ROE.

What's important is "Earning Power," or the ability to earn more profits with the same amount of capital. PER increases with improved profit growth rates and lower capital costs (or cost of equity).

To raise PBR, a company must strengthen its "Earning Power" to achieve a high ROE that exceeds its capital costs (or cost of equity). It is also necessary to formulate and implement a growth strategy.

Management that "Sustainably" strengthens both "Earning Power" and "Growth" is key.

Source) NRI

3 Point of Raise PBR

There are 3 approaches to raise PBR.

Breaking down the PBR calculation formula,

- ①Raise ROE

- ②Optimizing Capital Costs

- ③Increasing Sustainable Growth Rates

These are implemented continuously over the long term, and if changes to the company's stock price or capital structure are necessary, M&A can sometimes be a solution.

Source) NRI

①Raise ROE = “Improving Earning Power”

ROE, or earning power, can be improved by increasing profits in each business, increasing profits across the portfolio, and efficiently utilizing assets.

Considering the company's vision and profitability, the company may choose to sell its shares, buy back its own shares, or withdraw from or sell businesses.

②Optimizing Capital Costs = “Risk Reduction”

In the VUCA era, it is important to constantly understand risks and consider countermeasures, including responding to environmental changes.

It needs to understand the characteristics of company's business, identify its strengths, weaknesses, opportunities, and threats, and respond to the changing environment with a long-term perspective.

③Increasing Sustainable Growth Rates = “Strategy and Investment”

Sustainable management requires not only consideration of innovation, such as creating new businesses and transforming existing ones, but also strengthening governance, such as collaboration between management and the field, and establishing a system that enables appropriate and rapid decision-making.

Furthermore, a long-term strategy that considers the company's strengths and social issues is also necessary, necessitating a back casting strategy.

Profile

-

Mayuko TaniguchiPortraits of Mayuko Taniguchi

Consulting Business Development Department

* Organization names and job titles may differ from the current version.